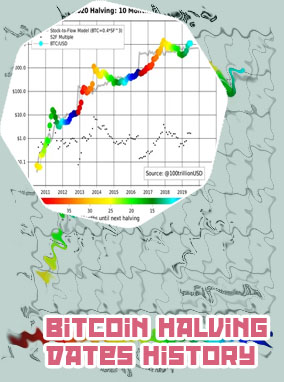

Bitcoin halving chart

Recommended For You

If you’re unsure how halvings work or why they’re significant, you may also be wondering why they’re relevant to price. In this article, we’ll explain what a Bitcoin halving is, and will look at its historical price impact. Bitcoin halving dates chart From the chart, it’s visible that the latest BTC halving cycle is currently around 75% done, meaning that the miners have mined about 157,500 blocks in this cycle so far.

Btc halving chart

The halving happens every 210,000 blocks. The 2024 halving will happen on block 840,000. Bitcoin Halving Charts: Historical Price Action Analysis The RSI confirms the downward trend on Bitcoin as it targets the oversold territory below the 30 level. For the confirmation of the formation, the price needs to break below the neckline at $22,072. In the face of such a breakout, bears could push the price of the largest cryptocurrency below $20,000. With a sudden increase in volume accompanying this price movement, the ultimate target could be around $15,500, the last bottom level.Bitcoin Halving 2020

Today, bitcoin’s inflation rate stands at 1.78%. After the next halving, in April 2024, this inflation rate will fall to 1.1%. This ever-increasing scarcity has to date coincided with large upswings in the value of the number one digital asset. The Rising Dollar and Bitcoin NMR may experience the after-effects of the Bitcoin halving and is expected to trade much higher than its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, NMR will continue to rise in 2025 forming new resistance levels. It is expected that NMR will trade beyond the $120 level.